The Chief Executive Officer, Paga Group, Tayo Oviosu says Fintechs in the country could explore the massive opportunities available in the pan African banking group; Ecobank, to grow and expand their business locally and across the African continent.

Oviosu who was speaking on the topic “Pan-African Expansion: Opportunities and Challenges” at the hybrid maiden Ecobank Fintech Breakfast Series: ‘Partnering for a stronger ecosystem’ submitted that Fintechs could leverage Ecobank’s footprint, infrastructure and network across Africa including the in-depth knowledge of regulatory policies and legal requirements in respective countries to achieve their growth and expansion goal.

According to him, “Banks should not be afraid to do business with Fintechs. Partnership and collaboration are welcome. That is the practice all over the world. Technology is evolving. Ecobank’s pan African presence is ideal for such partnership.

“Fintechs can leverage on the bank’s footprints across geographies, market knowledge and experience in the legal entities and launch out. They must find a partner that has strength in what they are looking for like the Ecobank pan African switch, finance, technology and leverage it.”

He further advised Fintechs considering expansion to other countries to “do their due diligence, understand the cultural nuances of the environment and how friendly the country is to foreign businesses.”

“Take note of your type of business, the available opportunities, challenges, and the scale you are building. It is fine to assemble a local team that will help you understand the environment better”, he added.

In his comment on “How bank-Fintech collaborations can drive ecosystem growth”, Group Head, Payments, Cash Management and Client Access, Ecobank Group, Isaac Kamuta, reconfirmed Ecobank’s commitment to supporting African Fintechs to grow.

“As a bank, we are committed to supporting anybody out there that has a dream to succeed and that was why Ecobank was started. It was established to help Africans and deliver banking services to Africans on the continent. So, we have a mission in ensuring that any African that has a dream, can get that dream fulfilled.

“We want everybody to succeed, we want more and more unicorns to come out of Africa- generate employment and make financial services available to everybody, irrespective of their location or economic class. It is not enough to just have a solution; it is more about the execution. With the experience we have in this sector, we are always able to provide advisory service and help would-be unicorns to build and scale.

“As a bank, we cover all the key sectors, working with everybody from Agriculture to transport, telecommunications amongst others. We provide insight through a pan African banking mindset, and not just Nigeria’s point of view because we operate in 33 countries in Africa. We are always going to sit down with you, listen to the problems, bring in the African perspective, the local knowledge, and the country’s origin. And of course, governance is important”.

Earlier in his welcome address, Managing Director, Ecobank Nigeria, Bolaji Lawal said the Fintech Breakfast Series is to learn and share ideas among players in the industry, stating that such partnerships and collaboration will expand the ecosystem and make the environment better to grow the nation’s economy.

“Many believe banks and Fintech are competitors. That is not true. This seminar is on how Fintech firms can find and nurture partnerships with banks, and how they can leverage these partnerships to grow and expand across the continent.

“It is an opportunity for Fintech founders and executives to say what they are looking for from banks. It will also deepen skills for businesses and grow knowledge of the financial services industry”, he stated.

Other speakers at the event included Co-founder & CEO, Bankly, Tomilola Majekodunmi and Africa Partner, QED, Gbenga Ajayi.

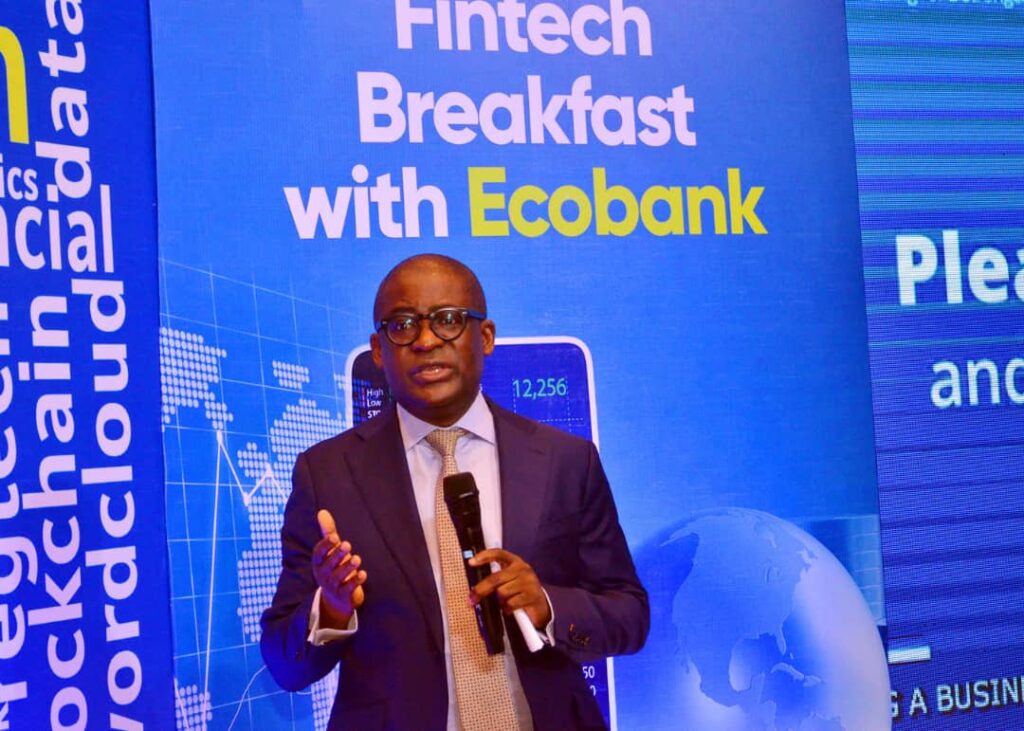

Photo: Bolaji Lawal, Managing Director, Ecobank Nigeria Limited.

Send your press invite, news, press releases/articles to augustinenwadinamuo@yahoo.com. Also, follow us on Twitter @ptreporters and on Facebook on facebook.com/primetimereporters or call the editor on 07030661526, 08053908817.