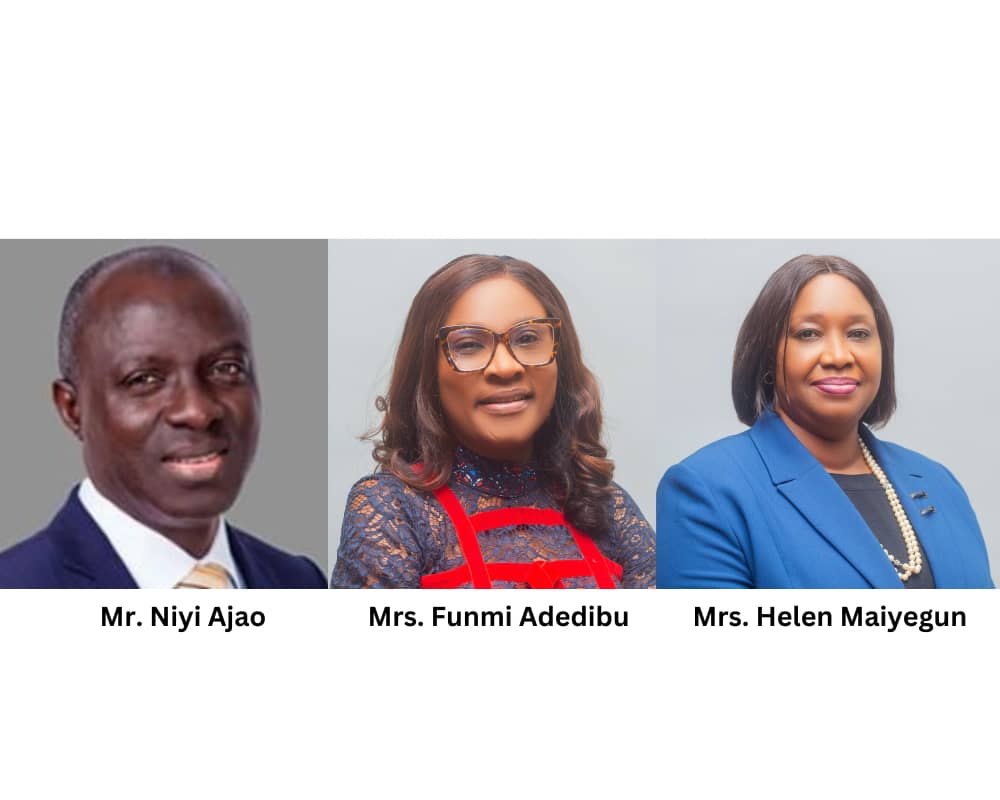

The Board of Directors of CRC Credit Bureau Limited has announced the appointment of three new Directors across the group following the receipt of all required regulatory approvals.

The appointees are: Mr. Niyi Ajao as an Independent Non-Executive Director and Mrs. Funmi Adedibu, Mrs. Helen Maiyegun as Non-Executive Directors.

Mr. Niyi Ajao brings to the Board of CRC, over 30 years of cumulative work experience in the financial services Industry in innovation and emerging technologies, operations, electronic payments and settlement systems management, digital financial services, and business development. He is the Founder/CEO of Digital Finance Solutions Nigeria Limited.

Mr. Ajao previously served as Executive Director and later as the Deputy Managing Director of Nigeria Inter-Bank Settlement System (NIBSS) Plc between May 2019 and April 2021. He led the development and management of a number of landmark innovations while at NIBSS.

He holds a Bachelor’s degree and an Executive MBA from Obafemi Awolowo University, Ile-Ife. He is an Honorary Senior Member, Chartered Institute of Bankers of Nigeria (CIBN), Life member of the Institute of Directors (IoD) and several other professional bodies. He is an alumnus of the Lagos Business School, and the Wharton Business School, University of Pennsylvania.

Mrs. Funmi Adedibu is a lawyer with wealth of experience spanning over 25 years legal practice and banking. She is currently the Group Company Secretary and General Counsel of the FCMB Group Plc.

Mrs Adedibu attended several Leadership and Management trainings from Harvard Business School, Queen’s School of Business Canada, Lagos Business School as well as Euromoney Loan Documentation and Advanced Loan Documentation Trainings in New York.

She is a member of the Nigerian Bar Association (NBA), International Bar Association (IBA), Life member of the Institute of Directors (IoD), an Honorary member of the Chartered Institute of Bankers of Nigeria (HCIB) and Toastmasters International.

She obtained a Bachelor’s degree in Law from the prestigious Obafemi Awolowo University and Master’s degree in Law from the University of Lagos. She attended the Nigerian Law School.

Mrs. Helen Maiyegun is a Banking professional with over 26 years industry experience. Her knowledge and expertise cuts across corporate, commercial, customer retail banking and financial institutions. She is presently the Regional Head, Lagos 1 Region, Lagos and West Directorate, at Keystone Bank.

She holds a Bachelor’s and Master’s degrees in Psychology from Universities of Jos and Lagos respectively. She has attended several local and offshore courses including Leadership for Senior Managers, Dubai, UAE (2013), Women on Board Development, IE Business School, Madrid, Spain (2015) and Executive Decision Making, University of California, Berkeley, USA.

Mrs. Maiyegun served as a Non-Executive Director in Keystone Bank, Sierra Leone until recently. She is the Chairperson of the Keystone Bank’s Women Economic Empowerment Committee (KWEEC), an initiative of the Central Bank of Nigeria. She is also a Faculty Member at the Keystone Bank Learning Academy.

Commenting on the appointment, the Chairman of Board of Directors of CRC Credit Bureau, Mr. Olusegun Alebiosu, stated that the board is very pleased to welcome the new Directors after the company transitioned into a group structure.

According to him, “I am certain that the new directors will put their vast wealth of experience at the disposal of the Board as they join other highly experienced Directors to take the company on its next phase of growth and expansion”.

CRC Credit Bureau Limited operates under a group structure consisting of the bureau business and its subsidiary, CRC Data and Analytics Limited.

CRC Credit Bureau Limited was incorporated in 2006 by a consortium of ten Nigerian commercial banks and a technical partner, Dun & Bradstreet – operating under world’s best practices has evolved its product line-up to enable partners to gain deeper insights to customer understanding, conduct targeted marketing campaigns and support informed decision-making.With a head office in Lagos Nigeria,

CRC Credit Bureau is known in Nigeria and among the global community, as a trend setter and solutions provider.

We continuously develop innovative products and services that assist partners have a better understanding of their customers using credit and alternative data. CRC Credit Bureau gives partners a 360-view of their customers, pulling from various data sources, as well as social media channels, to understand trends and analysis enabling them to make strategic decisions.

Advanced data analysis and artificial intelligence is utilized by over 2,000 partners to make strategic decisions. The company is also implementing platforms that seek to assist institutions revolutionize and digitize their business operations, building IT capacity and digital straight through processes using Application Programming Interfaces (APIs).

Send your press invite, news, press releases/articles to augustinenwadinamuo@yahoo.com. Also, follow us on Twitter @PrimetimeRepor1 and on Facebook on facebook.com/primetimereporters or call the editor on 07030661526.