…Senate to discuss motion on interest rates

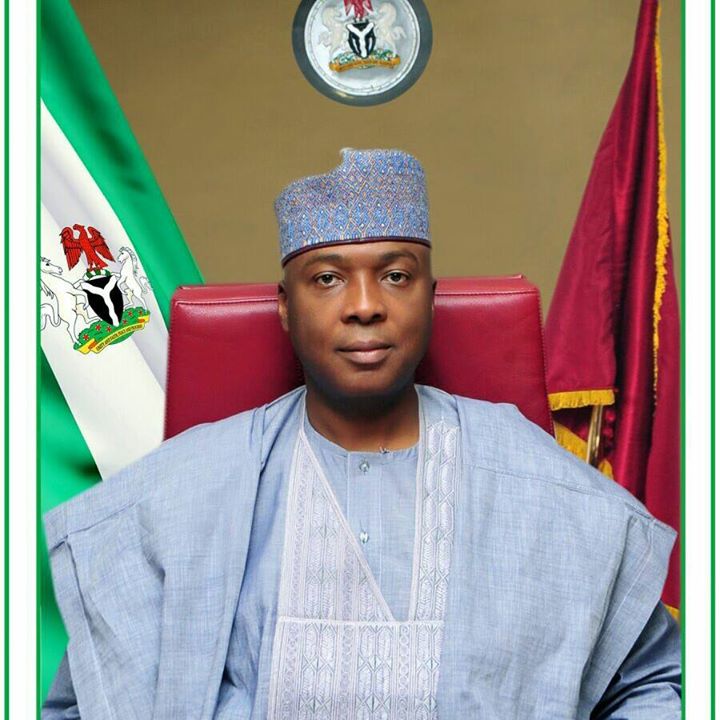

President of the Senate, Dr. Abubakar Bukola Saraki, has stated that contrary to wrong interpretations in the media on a recommendation by the Senate Committee on Works, the proposed National Road Fund Bill would not lead to any increase in the current price of fuel.

Speaking with reporters in Ilorin on Saturday after the breaking of fast, Saraki also said the Senate would this week discuss a motion on the interest rates being charged by commercial banks on loans to customers, particularly entrepreneurs who need borrowed funds to stay afloat and contribute to the Gross Domestic Product (GDP).

He said the report of the Senate Committee which worked on the National Road Funds Bill came from deliberations during a public hearing in which all stakeholders made different suggestions on how to generate funds for maintenance of the nation’s road network but that there was a consensus on the desirability of the Fund and the need to ensure that the money to be generated from sale of fuel for the fund should be accommodated within the current price regime.

“This is an opportunity to clarify the inaccurate reporting. There is a Bill called the National Road Funds Bill. Our roads around the country are not adequately funded. If we are banking on the appropriations process, we will not be able to adequately fund and refurbish our roads.

“Anybody that read the full report would have known that after the public hearing, which involved stakeholders from the road and transport industry, it was recommended that N5.00 (five naira) from each litre of petrol should be channeled towards our roads. However, this is not going to be additional five naira, but five naira out of the present price of N145 that Nigerians are currently paying at the pump,” the Senate President said.

“The recommendations came from the engagement with stakeholders at the public hearing on the bill. One of the conditions attached to the new charges by all stakeholders was that this five naira should not be an increase, but come from what already exists. It is believed that the existing charges in the present price regime would be reduced to accommodate the five naira Road Fund bill.

“Nigerians should be reassured that although we have not even debated these recommendations, the committee’s report came with a clear proviso that the five naira should come from a restructuring of the existing template, which is reshuffling the taxes in the current N145 — so that five naira out of this will always be pushed to develop existing roads and build new ones”, he said.

He added that this week, the Senate would discuss and take a decision on the interest rates being charged by commercial banks as he said the prevailing rates were too high and discouraging to genuine industrialists and entrepreneurs who need to accommodate the cost of money alongside other costs to fix prices of goods and services.

“If we genuinely want to stimulate local manufacturing and development of the small and medium enterprises so as to generate employment and help our national economy to recover from recession, then people must be able to borrow money at reasonable interest rates. It is difficult for manufacturers to survive while borrowing at about 28 per cent,” he said.

Send your news, press releases/articles as well as your adverts to info@primetimereporters.com. Also, follow us on Twitter @reportersinfo and on Facebook on facebook.com/primetimereporters or call the editor on 07030661526, 08053908817.